A tax reform is currently being developed in Luxembourg, what impact will it have on households?

Towards greater tax equality

In 2023, the government included the intention to introduce a tax reform law in its programme. The proposed bill is expected to be presented by 2026, with the reform coming into effect on 1 January 2028 and applying to that same tax year.

The aim of the reform is to establish a single tax class and put an end to the current three classes:

- Class 1, the basic class, which includes all single or divorced individuals with no dependent children.

- Class 1A, which covers single individuals with at least one dependent child. This class is more advantageous, aiming to reduce the tax burden for single-parent families.

- Class 2, which applies to married or civil partnership (PACS) couples. In this class, both partners’ incomes are combined, divided by two, and the tax due on that amount is then doubled. This system can be beneficial, particularly if one partner earns significantly less than the other, as it allows the couple to fall into lower tax brackets.

Under the new unified system, the rate will be close to that of the current Class 1A for everyone.

This reform would therefore mark the end of considering marital status in the calculation of income tax, a system that has been in place since 1842.

If you wish to learn how to complete your 2025 tax return, you can find all the useful information in our guide.

The reasons behind the government’s decision

This reform will cost the Luxembourgish state around €800 to €900 million per year but will promote greater equality among all households. The government has decided to implement these changes largely due to significant societal evolution.

The current system dates back to 1960, a time when few women were employed and could not even open a bank account without their husband’s consent. Today, the employment rate of second earners stands at 67%, meaning that the existing calculation method is no longer relevant for the majority of taxpayers.

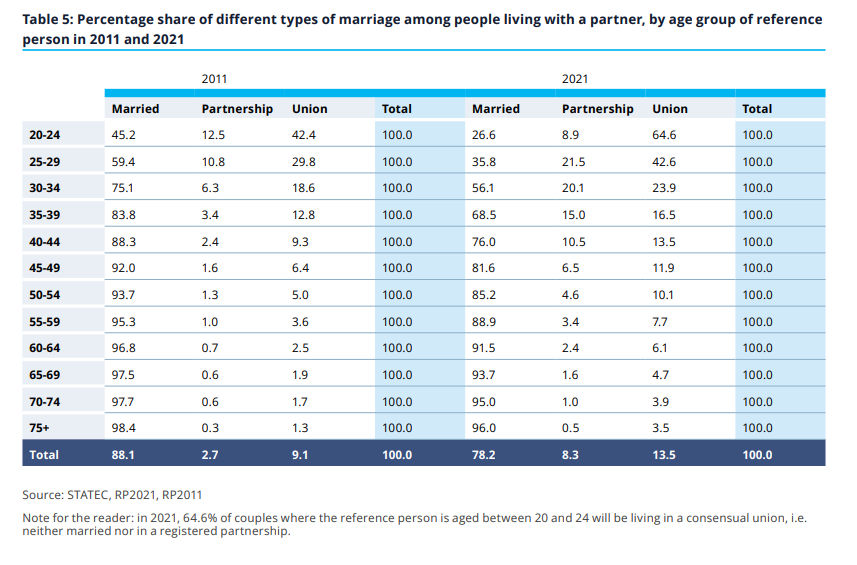

Below is a STATEC study showing that, over ten years between 2011 and 2021, the proportion of married couples has fallen significantly, especially among younger generations. However, the number of couples in civil partnerships has increased. With the end of tax advantages, these figures could decline again after 2028.

Graph from STATEC about marital status of households in Luxembourg.

The impact of these changes on the purchasing power of luxembourg residents

The new system will therefore benefit single people and unmarried couples, while married or civil partnership couples will have fewer advantages than before. However, couples who are already united before the reform will continue to benefit from their current advantages during a 20-year transition period.

The objective of this reform is to create a fairer and more equitable tax system for everyone.

Find more articles about taxation in Luxembourg on our blog.

.png)