In this series of articles, discover various professions you can find in Luxembourg.

The accounting profession

The accountant plays a key role within a company, regardless of its size! They are true experts in numbers, and responsible for managing the accounting and tax aspects of the business. The tasks of an accountant can differ based on the size of the organisation.

Over the years, an accountant can specialise and progress within the organisation, and through internal promotions, become a senior associate, accounting manager, management controller, or even a Chief Financial Officer (CFO).

If you work in a firm, you can move towards financial analysis roles such as auditor or financial analyst. Years of experience and skill development can lead you to a position as a certified accountant.

Education and skills

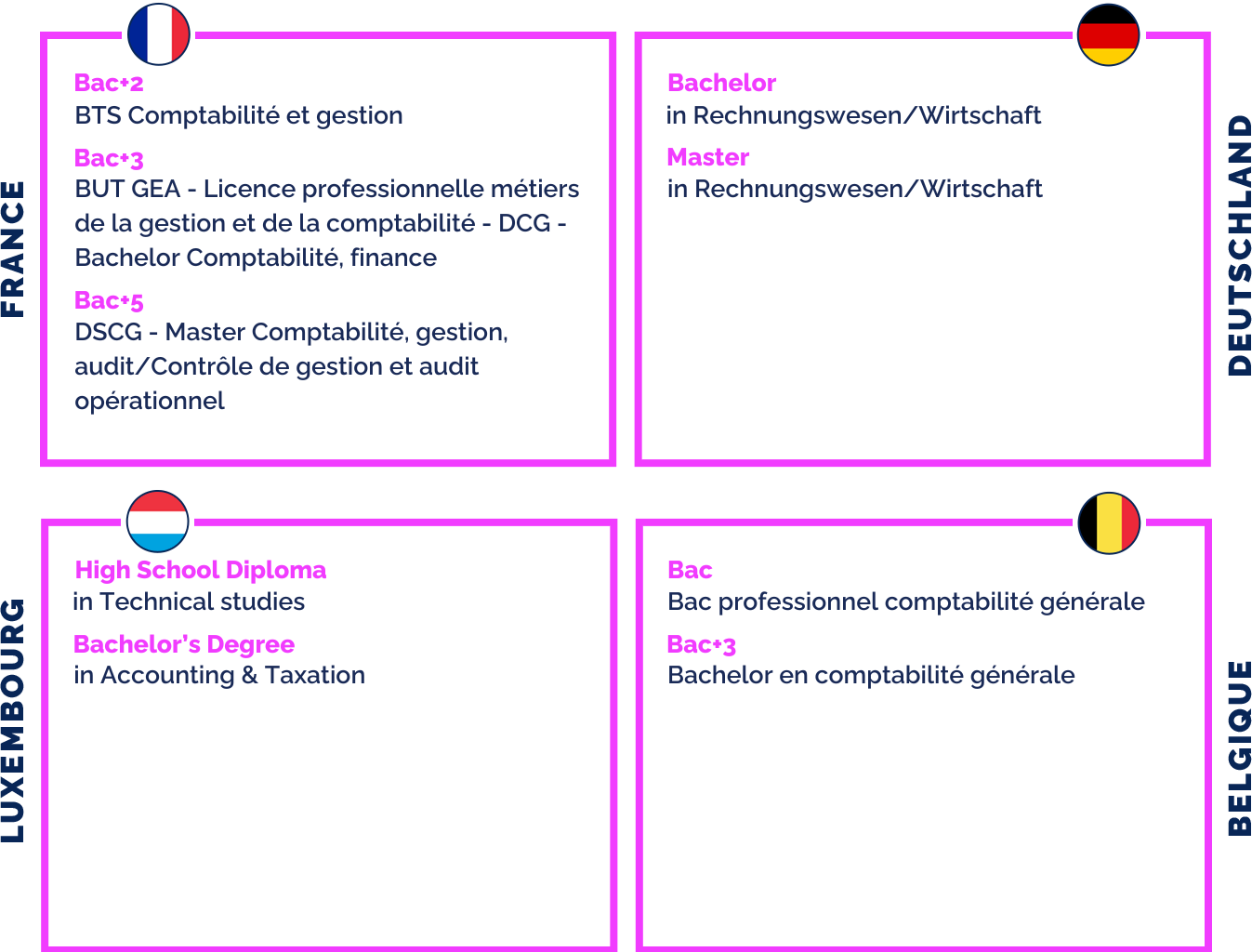

Several education programs allow access to the accounting profession:

Table showing French, German, Luxembourg and Belgian qualification levels for the accounting profession in Luxembourg

These education programs provide the necessary skills to work in this profession:

- Proficiency in accounting software and MS Office tools

- In-depth knowledge of the tax and social laws in force in Luxembourg

- Ability to navigate Luxembourg's VAT rates

- Excellent analytical and problem-solving skills

- Good understanding of Lux GAAP (accounting standards)

A good accountant must also be rigorous, concise, discreet, and methodical, among other qualities!

Do you enjoy working with numbers?

Are you able to act with caution on a daily basis?

Do you pay great attention to detail?

Do you have a good ability to handle stress?

If you answered "Yes" to these questions, congratulations: you have every chance of thriving as an accountant!

The different types of accountants

The multitasking accountant in SMEs:

In a small business, an accountant must be versatile! Their tasks are quite varied, requiring them to be involved in multiple areas. These tasks range from creating invoices and following up with clients to recording transactions, monitoring payments, and processing supplier and client invoices. Each year, they prepare the annual financial closing by preparing balance sheets and income statements. The accountant serves as a vital link between the company and its fiduciary for various tasks, such as preparing payroll and tax declarations.

The specialised accountant in a large company:

In a large organisation, the role of an accountant is quite different. Here, they work within a team and can specialise as a supplier accountant, client accountant, payroll accountant, analytical accountant, or general accountant. The entire team is under the supervision of an accounting manager.

The accountant in an accounting firm:

Under the supervision of a certified public accountant, the accountant manages the complete accounting for various clients with whom they communicate regularly and report back, particularly through annual financial statements.

Being an accountant in Luxembourg

The salary of a junior accountant can start at €37,000 gross annually.

With experience, such as becoming an accounting manager, the salary can range between €60,000 and €70,000 gross annually.

An experienced Chief Financial Officer (CFO) can even earn more than €140,000 annually.

Of course, various factors can influence compensation, including whether the company is in the private or public sector and whether it is a specialised firm, among others.

Did you know?

Cross-border workers may face specific regulations concerning tax declarations. Some accountants need to be well-versed in handling cross-border tax declarations, considering the rules of all four countries involved.

Discover all accountant job offers in Luxembourg on Moovijob.com.

If you want to learn more about professions in Luxembourg, visit our blog.